NON RESIDENTS TAX FORM 210

WHAT IS FORM 210?

One of the most important forms you’ll need to familiarize yourself with is the Form 210, the Income Tax for Non Resident. A mandatory declaration for non residents who have earned income in Spain, such as rental revenue, capital gains, or income from self-employment

Income acquired without a PE is taxed at the following rates for non-residents:

- The general rate is 24%. The rate is 19% for residents of other EU member states or European Economic Area (EEA) nations with which there is an effective exchange of tax information.

- Capital gains from asset transfers are taxed at a 19% rate.

- The interest rate is 19%. For EU residents, interest is tax-free, as double taxation treaties (DTTs) often set lower rates.

- Dividends: 19%

- Royalties are taxed at 24%

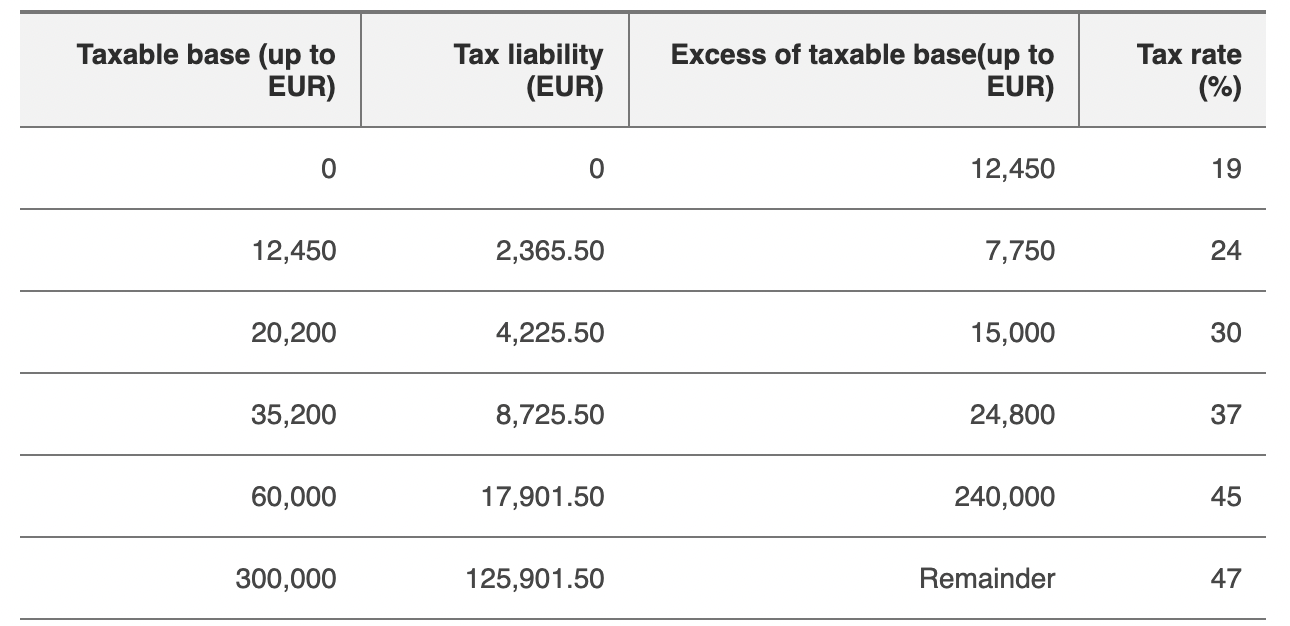

- Pensions are taxed at a graduated scale (between 8 percent and 40 percent).

SIM CARDS,PHONE REPAIRS AND ACCESORIES